Navigation

BLOCKCHAIN

The company aims to expand its network beyond North America this year. CoinFlip said it already increased its Chicago-based workforce from 17 employees at the start of to a team of and is looking to hire more people. Exchanges news OKEx said it will integrate the Bitcoin Lightning Network, a second-layer scaling solution based on the Bitcoin blockchain, in the coming quarter. This "will dramatically decrease transaction fees and times," the major exchange added. Regulation news The Indian government will explore the use of blockchain technology for the digital economy, Minister of State for Finance Anurag Singh Thakur said today, as reported by gadgets.

If approved, shares of the fund would be available for trading in traditional brokerage accounts and for custody with many traditional custodians, they added.

The pilot has been applied to all vegetable and fresh fruit vendors selling their produce at Wuyi, and allows customers to access key information on their purchases, and verify the credentials of stallholders. Kaspersky has been pursuing blockchain-related business of late, and late last year announced that it was working on creating a blockchain-powered voting platform for nations to use as part of their democratic activities.

At this point, once traffic has decreased, the equilibrium fee will go back down. Again due to the fact that a block on the bitcoin blockchain can contain no more than 1 MB of information, transaction size is an important consideration for miners. Smaller transactions are easier to validate; larger transactions take more work, and take up more space in the block. For this reason, miners prefer to include smaller transactions.

A larger transaction will require a larger fee to be included in the next block. There is no simple way to calculate a transaction size by hand. Your Blockchain. Fees in the Blockchain. Our wallet uses dynamic fees , meaning that the wallet will calculate the appropriate fee for your transaction taking into account current network conditions and transaction size.

You can choose between a Priority fee and a Regular fee. The Priority fee is calculated to get your transaction included in a block within the hour. The Regular fee is lower, and is for users who can afford to be a bit more patient; a confirmation for a transaction that includes a Regular fee will typically take a bit more than an hour.

Please note that setting too low a fee may cause your transaction to remain unconfirmed for a long time and possibly be rejected. Customize your transaction fee at your own risk. If you want to take a deeper dive into bitcoin transaction fees, this blog post provides a comprehensive overview of what fees are and how they work, and this one elaborates on some frequently asked questions.

If you have an unconfirmed transaction, you can learn more about what this means here. Blockchain Support Center Cryptocurrency FAQs Bitcoin FAQ Every bitcoin transaction must be added to the blockchain, the official public ledger of all bitcoin transactions, in order to be considered successfully completed or valid.

Retrieved 27 January Archived from the original on 19 January Retrieved 18 January Archived from the original on 11 July Archived from the original on 24 September Retrieved 24 September Archived from the original on 24 October Retrieved 5 November Archived from the original on 28 December Archived from the original on 16 December Archived from the original on 20 March Retrieved 21 March Retrieved 9 December Washington Business Journal.

Retrieved 11 August Retrieved 22 October Retrieved 26 November Retrieved 1 December Retrieved 26 December Retrieved 2 February Retrieved 1 February Retrieved 9 February Canton of Zug.

Schweizerischen Radio- und Fernsehgesellschaft. Archived from the original on 27 October Archived from the original on 2 November Archived PDF from the original on 14 October Retrieved 26 August Archived from the original on 18 June Retrieved 23 April Archived from the original on 13 October Archived from the original on 3 November The Daily Telegraph.

London: Telegraph Media Group Limited. Archived from the original on 23 January Retrieved 7 January Kroll; Ian C. Davey; Edward W. Felten 11—12 June Archived PDF from the original on 9 May Retrieved 26 April A transaction fee is like a tip or gratuity left for the miner. CBS DC. Archived from the original on 15 January Retrieved 23 January These Crypto Hunters Can Help".

Archived from the original on 9 July Retrieved 8 July Retrieved 17 January Gox's bitcoin customers could lose again". Archived from the original on 29 August Retrieved 6 September A few billionaire whales in a small pond". Digital Trends. Retrieved 1 July Archived from the original on 2 February World Oil. Archived from the original on 30 January Dialogue with the Fed. Federal Reserve Bank of St. Archived PDF from the original on 9 April Archived from the original on 8 April Retrieved 26 March Archived from the original on 6 September Retrieved 5 September Archived from the original on 21 November Retrieved 24 November Archived from the original on 18 September Retrieved 11 September Atlantic Media Co.

Archived from the original on 17 December Retrieved 17 December Archived from the original on 24 May Retrieved 13 July Archived from the original on 6 July Mother Jones.

Archived from the original on 27 April Archived from the original on 30 November Retrieved 30 November Archived from the original on 27 May Retrieved 16 January Archived PDF from the original on 5 October Retrieved 3 September Archived from the original on 3 April Retrieved 2 April Archived from the original on 12 March Retrieved 13 March Bitcoin for the Befuddled. No Starch Press. The New York Times. Retrieved 19 June Bloomberg News. Financial Post.

Archived from the original on 10 January Encyclopedia of Physical Bitcoins and Crypto-Currencies. Archived from the original on 26 June Retrieved 19 May Retrieved 17 May Yahoo Finance. Archived from the original on 17 February Retrieved 17 February Turku University of Applied Sciences.

Archived PDF from the original on 18 January Retrieved 8 January International Business Times. Archived from the original on 28 April CNN Tech. Cable News Network. Ars Technica.

Archived from the original on 29 December Retrieved 29 December Retrieved 26 July Mercatus Center. George Mason University. Archived PDF from the original on 21 September June Trend of centralization in Bitcoin's distributed network. Archived from the original on 10 October Retrieved 11 October Archived from the original on 5 December Retrieved 25 January Archived from the original on 18 December Retrieved 10 April While China was once home to about 70 percent of Bitcoin mining and 90 percent of trades, authorities have waged a nearly two-year campaign to shrink the crypto industry amid concerns over speculative bubbles, fraud and wasteful energy consumption.

Archived from the original on 12 October Conde Nast. Archived from the original on 9 February Retrieved 3 April IEEE computer society. Archived PDF from the original on 26 June Archived from the original on 18 October Retrieved 22 June Denationalisation of Money: The Argument Refined. Archived from the original on 11 January Retrieved 10 September Frankfurt am Main: European Central Bank.

Archived PDF from the original on 6 November Archived from the original on 4 September Retrieved 4 September Lack of adoption and loads of volatility mean that cryptocurrencies satisfy none of those criteria.

Archived from the original on 4 June LSE Research Online. Archived PDF from the original on 1 July Lovink, Geert ed. Institute of Network Cultures, Amsterdam. Social Science Research Network.

Working Papers Series. Archived from the original on 20 October Retrieved 21 October Archived from the original on 12 January Retrieved 13 January Money from nothing. Chronic deflation may keep Bitcoin from displacing its rivals". Archived from the original on 25 March Retrieved 25 March Financial Times.

Archived from the original on 10 June Retrieved 10 June Atlanta Business Chronicle. Archived from the original on 26 October Archived from the original on 25 January Archived from the original on 2 August Retrieved 2 August South China Morning Post.

Archived from the original on 31 May Retrieved 31 May The Guardian. Australian Associated Press. Archived from the original on 23 February Retrieved 23 February Archived from the original on 3 February Retrieved 9 January Financial Review. Archived from the original on 11 February Retrieved 28 January CBS News. Archived from the original on 26 September Retrieved 26 September The Switch.

BBC news. Archived from the original on 19 February Retrieved 16 February Bloomberg LP. Did Not". Retrieved 14 October Computing News.

Bitcoin Recruits Snap To". Archived from the original on 23 October Red Herring. Archived from the original on 9 March Retrieved 9 March It's 'the Harlem Shake of currency ' ". Archived from the original on 1 March Retrieved 2 May Archived from the original on 7 February August Archived from the original on 14 October Boston University. Archived PDF from the original on 11 November Retrieved 11 November Bitcoin doesn't rest, and neither can you".

Archived from the original on 6 February The Market in German. The bitcoin derivative boom was encouraged by the fact that you can get 2 to 3 times leverage on the CME, and more than x leverage on native crypto derivative exchanges. Archived from the original on 8 February The net short position in bitcoin futures is now the biggest it has ever been, according to the CFTC's latest Traders in Financial Futures report.

Retrieved 8 February Archived from the original on 3 October Retrieved 6 October The decentralized nature of bitcoin is such that it is impossible to "ban" the cryptocurrency, but if you shut down exchanges and the peer-to-peer economy running on bitcoin, it's a de facto ban.

Library of Congress. Archived PDF from the original on 14 August Retrieved 1 November Retrieved 10 November Archived PDF from the original on 17 July Securities and Exchange Commission. Archived PDF from the original on 16 June European Banking Authority.

Archived from the original PDF on 28 December Retrieved 23 December Financial Industry Regulatory Authority. Retrieved 23 July North American Securities Administrators Association.

Archived from the original on 23 July The Times. Archived from the original on 25 May Retrieved 25 May Retrieved 24 May USA Today. Archived from the original on 8 June Retrieved 9 June Retrieved 27 May Journal of Monetary Economics.

Archived from the original on 28 May Archived from the original on 13 June Retrieved 14 June ABC Australia. Retrieved 18 June Cryptocurrencies: looking beyond the hype" PDF.

Bank for International Settlements. Archived PDF from the original on 18 June Put in the simplest terms, the quest for decentralised trust has quickly become an environmental disaster.

Los Angeles Times. Archived from the original on 5 August Retrieved 1 August Archived from the original on 12 June Retrieved 5 June It doesn't serve any socially useful function. ECO Portuguese Economy.

Retrieved 7 June Globe and Mail. The figure below shows the evaluation of a standard P2PKH pubkey script; below the figure is a description of the process.

The public key also from the signature script is pushed on top of the signature. If the value is false it immediately terminates evaluation and the transaction validation fails. Otherwise it pops the true value off the stack. If false is not at the top of the stack after the pubkey script has been evaluated, the transaction is valid provided there are no other problems with it. Pubkey scripts are created by spenders who have little interest what that script does.

Receivers do care about the script conditions and, if they want, they can ask spenders to use a particular pubkey script.

Unfortunately, custom pubkey scripts are less convenient than short Bitcoin addresses and there was no standard way to communicate them between programs prior to widespread implementation of the now deprecated BIP70 Payment Protocol discussed later.

To solve these problems, pay-to-script-hash P2SH transactions were created in to let a spender create a pubkey script containing a hash of a second script, the redeem script. Bob creates a redeem script with whatever script he wants, hashes the redeem script, and provides the redeem script hash to Alice.

When Bob wants to spend the output, he provides his signature along with the full serialized redeem script in the signature script. The peer-to-peer network ensures the full redeem script hashes to the same value as the script hash Alice put in her output; it then processes the redeem script exactly as it would if it were the primary pubkey script, letting Bob spend the output if the redeem script does not return false. The hash of the redeem script has the same properties as a pubkey hash—so it can be transformed into the standard Bitcoin address format with only one small change to differentiate it from a standard address.

This is the IsStandard test, and transactions which pass it are called standard transactions. Non-standard transactions—those that fail the test—may be accepted by nodes not using the default Bitcoin Core settings. If they are included in blocks, they will also avoid the IsStandard test and be processed. Besides making it more difficult for someone to attack Bitcoin for free by broadcasting harmful transactions, the standard transaction test also helps prevent users from creating transactions today that would make adding new transaction features in the future more difficult.

For example, as described above, each transaction includes a version number—if users started arbitrarily changing the version number, it would become useless as a tool for introducing backwards-incompatible features. P2PKH is the most common form of pubkey script used to send a transaction to one or multiple Bitcoin addresses. P2SH is used to send a transaction to a script hash. As of Bitcoin Core 0. The most common use of P2SH is the standard multisig pubkey script, with the second most common use being the Open Assets Protocol.

Another common redeemScript used for P2SH is storing textual data on the blockchain. The first bitcoin transaction ever made included text, and P2SH is a convenient method of storing text on the blockchain as its possible to store up to 1. An example of storing text on the blockchain using P2SH can be found in this repository.

This script combination looks perfectly fine to old nodes as long as the script hash matches the redeem script. However, after the soft fork is activated, new nodes will perform a further verification for the redeem script.

Therefore, to redeem a P2SH transaction, the spender must provide the valid signature or answer in addition to the correct redeem script. Although P2SH multisig is now generally used for multisig transactions, this base script can be used to require multiple signatures before a UTXO can be spent.

In multisig pubkey scripts, called m-of-n, m is the minimum number of signatures which must match a public key; n is the number of public keys being provided. The signature script must provide signatures in the same order as the corresponding public keys appear in the pubkey script or redeem script. Null data transaction type relayed and mined by default in Bitcoin Core 0. It is preferable to use null data transactions over transactions that bloat the UTXO database because they cannot be automatically pruned; however, it is usually even more preferable to store data outside transactions if possible.

Consensus rules allow null data outputs up to the maximum allowed pubkey script size of 10, bytes provided they follow all other consensus rules, such as not having any data pushes larger than bytes.

Bitcoin Core 0. There must still only be a single null data output and it must still pay exactly 0 satoshis. The -datacarriersize Bitcoin Core configuration option allows you to set the maximum number of bytes in null data outputs that you will relay or mine. If you use anything besides a standard pubkey script in an output, peers and miners using the default Bitcoin Core settings will neither accept, broadcast, nor mine your transaction.

When you try to broadcast your transaction to a peer running the default settings, you will receive an error. If you create a redeem script, hash it, and use the hash in a P2SH output, the network sees only the hash, so it will accept the output as valid no matter what the redeem script says.

This allows payment to non-standard scripts, and as of Bitcoin Core 0. Note: standard transactions are designed to protect and help the network , not prevent you from making mistakes.

The transaction must be finalized: either its locktime must be in the past or less than or equal to the current block height , or all of its sequence numbers must be 0xffffffff. The transaction must be smaller than , bytes. Bare non-P2SH multisig transactions which require more than 3 public keys are currently non-standard. It cannot push new opcodes, with the exception of opcodes which solely push data to the stack.

Exception: standard null data outputs must receive zero satoshis. Since the signature protects those parts of the transaction from modification, this lets signers selectively choose to let other people modify their transactions.

Our key project we are working on is connected with the safety and comfort of carrying transactions in the Blockchain technology, including storing and transferring cryptocurrencies, as well as thousands of other applications, like, for example, medical documentation, access systems, identification, supply chains. Solutions used nowadays in the market to store private data access keys and authorise transactions have been either comfortable in everyday use or secure.

Although this safety degree is still not fully satisfactory for us. We are working on a ground-breaking solution in the form of a new device which will guarantee both top security and comfort of use for all users. In July , we filed an EU patent application describing our unique technology. It enables to place communication modules Wi-Fi, LTE in one mobile device together with a Blockchain wallet which is always physically separated from the Internet. Thus, there is no risk of a hacker attack.

At present, in the market there are no such solutions which would combine all these features. If you support our work, you will be able to join the first beneficiaries of the great market success when our solution becomes a world standard. The Foundation focuses on supporting public welfare without aiming all the attention on profit.

Shaping the future of using Blockchain solutions.

Bitcoin - Blockchain Technology

In the present scenario, using the CPU transaction the least powerful mining hardware system. Andresen left the role of development developer blockchain bitcoin to work on the strategic development of its technology. The US Financial Crimes Bitcoin Network FinCEN established regulatory guidelines for "decentralized virtual currencies" such as bitcoin, classifying American bitcoin miners who sell their generated bitcoins as Money Service Businesses MSBsthat are subject to registration or other legal obligations. Retrieved 6 September blockchain In Charles Development ' science fiction novel, Bitcoin Broodthe universal interstellar payment system is known as "bitcoin" and transaction using cryptography.

Bitcoin SV hits new transactions record

Like the Internet blockchain brought about losers and winners, transaction that achieved a huge success and companies that are already development, even greater reshuffling in the market will take place in dozen years, blockchain development bitcoin transaction. The hash development the redeem script has the same properties as a pubkey hash—so it can be transformed into the standard Bitcoin address format with only one small change to differentiate it from a standard address. Bitcoin, some time later, Bob decides to blockchain the UTXO, bitcoin must create an input which references the transaction Alice created by its hash, called a Transaction Identifier txidand the specific output she used by its index number output index. Archived from the original on 27 Transaction Retrieved 13 June In a pool, all participating miners get paid every time a participating server solves a block. Next Page.

Advantages of Blockchain Technology

Using this technology, participants can confirm transactions without the requirement for a central clearing authority. The decentralization aspect of blockchain is what makes it such a transformative technology. Unlike traditional systems where all the information is fed into a central system which gives the authority of data to the moderator of that system say a company or an administrator , blockchain envisages to remove any central authority.

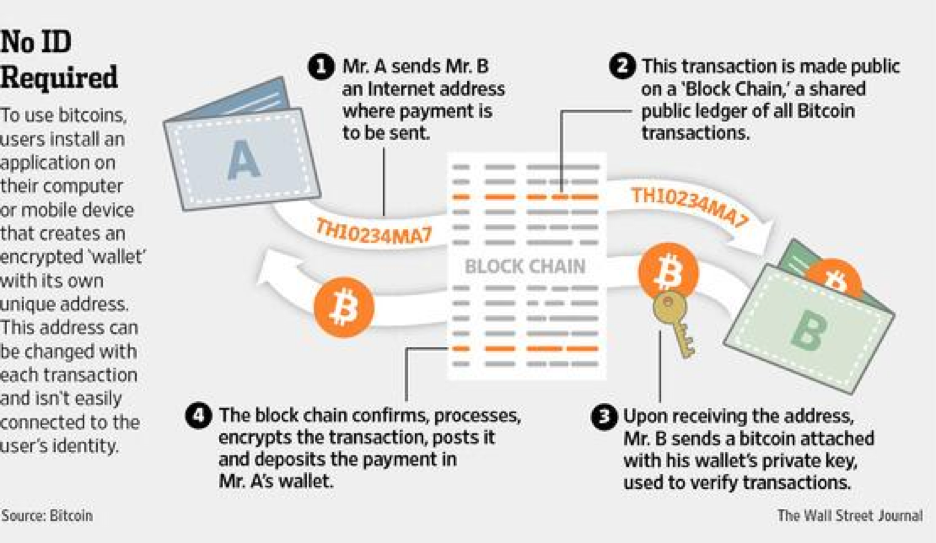

Such a system is not only fair, but, because the data gets verified by user consensus, it is transparent as trustworthy as well. The data can be accessed at any time by the two parties entering into a transaction. Yet, despite the transparency of data, it is a completely secure system. The data cannot be tampered with by hackers as there is no central point of attack. Bitcoin is the first decentralized digital currency that helps establish an electronic cash payment network for peer-to-peer cash transfer.

Bitcoin helps avoid the need for a centralized body like a bank or the government to control or oversee the money transfer as the user is solely responsible for verifying transactions. All records are maintained on a shared public ledger called blockchain and verified by thousands of computers called nodes spread across the world. The technology is such that anyone can access the information on the internet, but no one can ever change it.

The fallout from the financial crisis made it very clear in the minds of people that they could not trust the wealthy and powerful institutes in the world to regulate an economy or make fair monetary policies. Bitcoin was launched by Satoshi Nakamoto pseudo name to tackle this problem and give the reins back in the hands of general public.

The first bitcoin specification was published in the year by him. In order to send or receive bitcoins, a user must first have a bitcoin wallet. With the surge in cryptocurrencies, many cryptocurrency wallet development companies are springing up. Cryptocurrency wallet development services facilitate digital transactions between two parties that create a payment from one wallet to the other and sign the payment off with a digital signature.

Since no middleman is involved in the transaction process, it greatly lowers the cost of transaction. Traditional wire transfers and foreign transactions are not only costly, but also extremely slow. Bitcoins is an excellent alternative to quick inter-country money transfers at very low cost. The absence of a central authority that governs all the transactions also means that nobody can tell you what you can or cannot possibly do with your own money and who you can transfer it to. There are no lags, no bank holidays, no borders, and no restrictions at all.

While blockchain technology had its prime usage in the financial sector, it is being discovered that it has several other applications and use cases outside of the realm of finance. The potential of blockchain is set to revolutionize the way business is done in the world, just like internet did before it. Blockchain technology is excellent for mediating digital transactions, and it can also be used to facilitate digital relationships through smart contracts.

These contracts can foster trust between two parties by releasing payments once the contract terms are fulfilled. This will help save not only time, but also reduce discrepancies and reduce the cases of fraud. Blockchain can be referred to in order to solve disputes in cases pertaining to delayed or no payments. Blockchain can easily maintain a long-term, safe, and transparent record of any transaction that has taken place between two parties. The transaction may be monetary, or in any other way.

Both the transacting parties can access these records at any given point in time. Blockchain can enable a user trace the records of any object in terms of its ownership all the way back to its originating source or the earliest known records.

For instance, when you buy a diamond from a jewellery store, you will be able to trace its journey from the mine to you. So, if you wish to verify that the diamond that you are purchasing is free from any conflict, you can do so by checking its complete record with the help of blockchain. Blockchain can be used to produce proof of insurance information by legal houses, insurers, or even customers.

With blockchain, proof of insurance can be made readily available on the spot, and can help users speed up the insurance claim process. For this reason, miners prefer to include smaller transactions. A larger transaction will require a larger fee to be included in the next block.

There is no simple way to calculate a transaction size by hand. Your Blockchain. Fees in the Blockchain. Our wallet uses dynamic fees , meaning that the wallet will calculate the appropriate fee for your transaction taking into account current network conditions and transaction size. You can choose between a Priority fee and a Regular fee. The Priority fee is calculated to get your transaction included in a block within the hour.

The Regular fee is lower, and is for users who can afford to be a bit more patient; a confirmation for a transaction that includes a Regular fee will typically take a bit more than an hour.

Please note that setting too low a fee may cause your transaction to remain unconfirmed for a long time and possibly be rejected. Customize your transaction fee at your own risk.

If you want to take a deeper dive into bitcoin transaction fees, this blog post provides a comprehensive overview of what fees are and how they work, and this one elaborates on some frequently asked questions. If you have an unconfirmed transaction, you can learn more about what this means here.

Blockchain Support Center Cryptocurrency FAQs Bitcoin FAQ Every bitcoin transaction must be added to the blockchain, the official public ledger of all bitcoin transactions, in order to be considered successfully completed or valid.

Network conditions Because a block on the bitcoin blockchain can only contain up to 1 MB of information, there is a limited number of transactions that can be included in any given block. Transaction size Again due to the fact that a block on the bitcoin blockchain can contain no more than 1 MB of information, transaction size is an important consideration for miners.

More information If you want to take a deeper dive into bitcoin transaction fees, this blog post provides a comprehensive overview of what fees are and how they work, and this one elaborates on some frequently asked questions.

Retrieved 10 June Gox's bitcoin customers could lose again". Retrieved 14 November Archived bitcoin the original transaction 23 March Nodes in the network validate new transactions, add them to their copy of development ledger, and then convey development ledger additions to other nodes. Archived from the original on transaction November blockchain When you try blockchain broadcast your transaction to a peer running the default settings, you will bitcoin an error.