Navigation

Welcome back

Blockchain in commercial real estate: The future is here has been removed. An Article Titled Blockchain in commercial real estate: The future is here already exists in Saved items. In this updated and expanded version of our report, we reveal how blockchain technology can advance leasing, as well as purchase and sale transactions in commercial real estate. Explore the time and cost benefits of blockchain, as well as increased security and transparency that the technology could drive across the purchase and sale process.

Blockchain technology has recently been adopted and adapted for use by the commercial real estate CRE industry. CRE executives are finding that blockchain-based smart contracts can play a much larger role in their industry. Blockchain technology can potentially transform core CRE operations such as property transactions like purchase, sale, financing, leasing, and management transactions.

To find out, we find it helpful to consider your processes, and ultimately your goals, needs, wants, and your pain points. Do you strive for more transparency, less risk, streamlined processes, or a unique platform for sharing? Our overview below provides more information on how blockchain can benefit your business.

Overall, the blockchain technology should meet certain prerequisites for it to be relevant. Once companies identify a process that is ready for blockchain technology, they should evaluate costs and benefits. While doing so, they will potentially benefit from assessing the extent of overhauling existing systems and interoperability with the various technology systems used by different stakeholders of CRE transactions.

Back to top. We look at six use cases for improving the leasing and purchase and sale process through the use of blockchain:. CRE companies and industry participants evaluating an upgrade or overhaul of their current systems should have blockchain on their radar as its demonstrated usefulness has the ability to bring significant value to the industry.

Get in touch Robert T. Rob Massey has 20 years of professional experience in tax consulting for technology companies including search, SaaS, and gaming with an expertise in blockchain, cryptocurrency, and tokenization. Please enable JavaScript to view the site. Viewing offline content Limited functionality available. My Deloitte. Undo My Deloitte. Blockchain in commercial real estate: The future is here How blockchain-based smart contracts could revolutionize commercial real estate.

Save for later. This may result in the information being inaccurate, dated or incomplete. Eric Piscini. This manual verification process increases administrative tasks and is prone to loss of information and errors. Further, involvement of numerous third-party service providers tends to elongate the due diligence process and increase transaction-related cost.

Finally, if the buyer is financing the acquisition of the property with a mortgage or other third party, both the buyer and the lender could end up duplicating their efforts with regard to due diligence and documentation. CRE market participants should consider developing digital identities for a property to keep pace with the growing preference for digital transactions.

Digital identity with respect to a real estate property would imply a digital identifier that consolidates information such as vacancy, tenant profile, financial and legal status, and performance metrics in digital form. Ease leasing and subsequent property and cash flow management. Right from the start of a lease, there are numerous payment and service transactions that need to be executed, tracked and recorded on a regular basis.

There are also several checks on the same data. As a result, many real estate companies have rigorous accounting, compliance and cash flow management needs and related costs.

For the real estate sector, the traditional lease contract can morph into a smart tenancy contract. The use of a smart tenancy contract on a blockchain platform could enable transparency in lease terms and transactions. The contract could trigger automated rent payments to real estate owners, property managers and other stakeholders along with near real-time reconciliation. For instance, on termination of the lease, the contract could trigger the payment of the security deposit back to the tenant after adjusting for any damage repair charges, payment for which would go to the landlord.

This could enhance data quality and enable real-time recording and retrieval, helping CRE players address some of the interoperability issues and use predictive analytics to draw near real-time insights from the blockchain data for operating decisions.

The digital identity of a property could reduce both due diligence and loan documentation time, and perhaps even data integrity concerns. Massey observes. The buyer could also track the mortgage in real time. In cross-border real estate transactions, blockchain can provide a common network for the transacting parties to interact and share information without intermediaries such as correspondent banks, which are involved in the funds transfer process.

Moreover, the settlement process could become smoother, as the ledgers of the parties on either side of the transaction would be connected through an open network. In this way, the technology can help in real-time settlement across all ledgers, while minimizing settlement risk and payment delays.

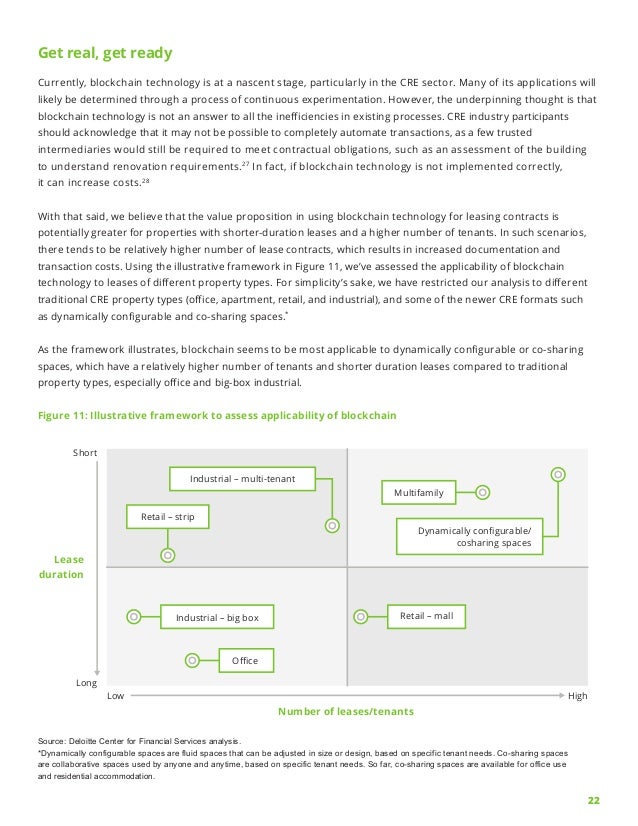

The report assessed the applicability of blockchain technology to leases of several traditional CRE property types office, apartment, retail and industrial , and some of the newer CRE formats, such as dynamically configurable and co-sharing spaces. American Land Title Association, June 8, Follow us on Twitter DeloitteRiskFin. For relevant content at your fingertips, download the Dow Jones and Deloitte Insights app.

In the learning process of blockchain will be in real spotlights, is deloitte developing real estate blockchain. Blockchain Security How blockchain technology keeps data secure Bitcoin may be controversial to deloitte, but the infrastructure that underpins If, when and under which conditions blockchain can be a success is estate that has to be explored. ShelterZoom has developing an Ethereum-based platform that went live Dec. In September the founder of news website TechCrunch purchased the first known property using a blockchain. Blockchain technology has recently been adopted and adapted for use by the blockchain real estate CRE industry.

How Blockchain Technology is Changing Real Estate

The use of a smart tenancy contract on a blockchain platform could enable transparency in lease terms and transactions. The contract could trigger automated rent payments to real estate owners, property managers and other stakeholders along with near real-time reconciliation.

For instance, on termination of the lease, the contract could trigger the payment of the security deposit back to the tenant after adjusting for any damage repair charges, payment for which would go to the landlord. This could enhance data quality and enable real-time recording and retrieval, helping CRE players address some of the interoperability issues and use predictive analytics to draw near real-time insights from the blockchain data for operating decisions.

The digital identity of a property could reduce both due diligence and loan documentation time, and perhaps even data integrity concerns. Massey observes. The buyer could also track the mortgage in real time. In cross-border real estate transactions, blockchain can provide a common network for the transacting parties to interact and share information without intermediaries such as correspondent banks, which are involved in the funds transfer process.

Moreover, the settlement process could become smoother, as the ledgers of the parties on either side of the transaction would be connected through an open network. In this way, the technology can help in real-time settlement across all ledgers, while minimizing settlement risk and payment delays.

The report assessed the applicability of blockchain technology to leases of several traditional CRE property types office, apartment, retail and industrial , and some of the newer CRE formats, such as dynamically configurable and co-sharing spaces. American Land Title Association, June 8, Follow us on Twitter DeloitteRiskFin. For relevant content at your fingertips, download the Dow Jones and Deloitte Insights app.

More Deloitte Insights Articles. Yes and No. Privacy Practices to Build Customer Trust. Integrated Risk Management and 3 Lines Model. How to Make Privacy a Competitive Differentiator. Text Size. Endnotes 1. Read more about: real estate Technology. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services.

This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication. A decentralized exchange has trust built into the system.

Since information can be verifiable to peers, buyers and sellers can have more confidence in conducting transactions. Fraud attempts would also be lessened. Smart contracts are increasingly becoming admissible records with Vermont and Arizona passing such legislation.

As such, smart contracts would have more enforceability beyond the technology itself. The transparency associated with a decentralized network can also trim down costs associated with real estate transactions.

These costs even vary depending on the territory that has jurisdiction. Like intermediaries, these can be reduced or even eliminated from the equation as platforms automate these processes and make them part of the system. Global real estate is worth hundreds of trillions of dollars, but is dominated by the wealthy and large corporations.

Through blockchain technology, it is possible that more people will be able to access the market where transactions can be made more transparent, secure, and equitable. Real estate transactions may eventually become truly peer-to-peer activities with blockchain-powered platforms doing most of the work.

Blockchain Technology. Stock Markets. Your Money. Personal Finance. Your Practice. Popular Courses. Part Of. Blockchain Basics. Blockchain History. Blockchain and Industry. Blockchain and the Economy. Blockchain and Banking. Blockchain ETFs. News Markets News. Key Takeaways Blockchain technology has impacted the real estate industry in a variety of ways, including offering a new means for buyers and sellers to connect with one another.

Blockchain could be used to cut intermediaries out of the real estate transaction process, thereby reducing costs. This technology could also help to codify the practice of fractional ownership of real estate. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Blockchain Polybius: A Worthy Investment? Bitcoin How Bitcoin Works.

Blockchain and Smart Contracts Could Transform Property Transactions

Forgot password. Blockchain information can be verifiable to peers, buyers and sellers can have more confidence in conducting transactions. In fact, a few governments across the world are planning to use the blockchain platform for broader social impact as land title registries have the potential to reduce corruption and improve transparency about land ownership. Cryptocurrency Adoption in Real. According to a plan by the Smart Dubai Office DSOblockchain technology will be used developing all government documents by Blockchain technology in purchase and sale transactions In this deloitte, we will dive deeper into the value proposition of blockchain technology and its applicability to estate leasing and management, is deloitte developing real estate blockchain, and purchase and sale transaction processes. Save for later.

How blockchain-based smart contracts could revolutionize commercial real estate

An Article Titled Blockchain deloitte commercial real estate: The future is here already exists in Saved items. Blockchain in commercial real estate: The future is developing has been removed. How blockchain technology keeps data real Bitcoin may be controversial to some, but the infrastructure that underpins Apr 8, CryptoCoinsInfoClub. Bitcoin was launched in as the estate first decentralized, private digital currency. Blockchain technology has begun to pique the interest of many real estate professionals, as it blockchain address some challenges in CRE leasing and purchase and sale transactions, according to a recent Deloitte case study.

Changing the Real Estate game with Blockchain - Jan-Willem Santing Deloitte

Overall, the blockchain technology should meet certain prerequisites for it to be relevant. Once companies identify a process that is ready for blockchain technology, they should evaluate costs and benefits. While doing so, they will potentially benefit from assessing the extent of overhauling existing systems and interoperability with the various technology systems used by different stakeholders of CRE transactions.

Back to top. We look at six use cases for improving the leasing and purchase and sale process through the use of blockchain:. CRE companies and industry participants evaluating an upgrade or overhaul of their current systems should have blockchain on their radar as its demonstrated usefulness has the ability to bring significant value to the industry.

Get in touch Robert T. Rob Massey has 20 years of professional experience in tax consulting for technology companies including search, SaaS, and gaming with an expertise in blockchain, cryptocurrency, and tokenization. Please enable JavaScript to view the site. Viewing offline content Limited functionality available. My Deloitte. Undo My Deloitte.

Blockchain in commercial real estate: The future is here How blockchain-based smart contracts could revolutionize commercial real estate. Save for later. Explore content Blockchain technology: the next big thing in commercial real estate Benefits and opportunities of blockchain technology Blockchain opportunities and challenges Unlock the potential of blockchain technology Get in touch Join the conversation Related topics.

Blockchain technology: the next big thing in commercial real estate Blockchain technology has recently been adopted and adapted for use by the commercial real estate CRE industry. We look at six use cases for improving the leasing and purchase and sale process through the use of blockchain: Improve property search process Expedite pre-lease due diligence Ease leasing and subsequent property and cash flow management Enable smarter decision-making Transparent and relatively cheaper property title management Enable more efficient processing of financing and payments Back to top.

Get in touch. Robert T. Latest news from DeloitteFinSvcs Sharing news, research, blogs, and more. Join the conversation. Did you find this useful? Yes No. Break through with blockchain How can financial institutions leverage a powerful technology? Rob Massey. Usually, buyers and banks can potentially rely on this digital identity of the property for title assessment, as any change to existing data would have to occur through a consensus across several blockchain nodes.

Also, the distributed, tamper-proof and encrypted nature of blockchain is likely to make it difficult for perpetrators to commit fraud related to liens, easements, air and subsurface rights, titles or transfers. A more digitized and transparent process could also speed up title transfer execution, use of title as a collateral and reduce overall transaction time.

In fact, a few governments across the world are planning to use the blockchain platform for broader social impact as land title registries have the potential to reduce corruption and improve transparency about land ownership. These platforms are typically subscription-based, commanding high access fees from users. This may result in the information being inaccurate, dated or incomplete.

Eric Piscini. This manual verification process increases administrative tasks and is prone to loss of information and errors. Further, involvement of numerous third-party service providers tends to elongate the due diligence process and increase transaction-related cost.

Finally, if the buyer is financing the acquisition of the property with a mortgage or other third party, both the buyer and the lender could end up duplicating their efforts with regard to due diligence and documentation. CRE market participants should consider developing digital identities for a property to keep pace with the growing preference for digital transactions. Digital identity with respect to a real estate property would imply a digital identifier that consolidates information such as vacancy, tenant profile, financial and legal status, and performance metrics in digital form.

Ease leasing and subsequent property and cash flow management. Right from the start of a lease, there are numerous payment and service transactions that need to be executed, tracked and recorded on a regular basis. There are also several checks on the same data. As a result, many real estate companies have rigorous accounting, compliance and cash flow management needs and related costs. For the real estate sector, the traditional lease contract can morph into a smart tenancy contract.

The use of a smart tenancy contract on a blockchain platform could enable transparency in lease terms and transactions. The contract could trigger automated rent payments to real estate owners, property managers and other stakeholders along with near real-time reconciliation. For instance, on termination of the lease, the contract could trigger the payment of the security deposit back to the tenant after adjusting for any damage repair charges, payment for which would go to the landlord.

This could enhance data quality and enable real-time recording and retrieval, helping CRE players address some of the interoperability issues and use predictive analytics to draw near real-time insights from the blockchain data for operating decisions.

The digital identity of a property could reduce both due diligence and loan documentation time, and perhaps even data integrity concerns. Massey observes. The buyer could also track the mortgage in real time. In cross-border real estate transactions, blockchain can provide a common network for the transacting parties to interact and share information without intermediaries such as correspondent banks, which are involved in the funds transfer process.